Fintech gini reveals an industry survey to identify Open Banking opportunities and obstacles

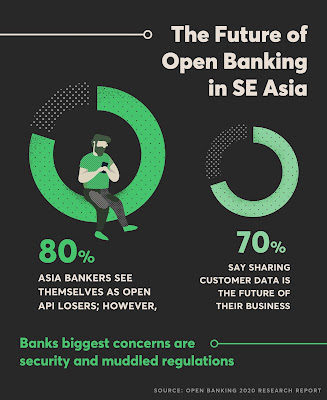

HONG KONG, Dec 12 (Bernama-BUSINESS WIRE) -- gini, the Hong Kong based data-driven banking solutions provider reveals a recent survey on Open APIs readiness among Asian fintech industry professionals. Only 20% of bankers saw themselves as the winners from Open APIs, even though 70% said sharing customer data is the future of their business. Fintechs are viewed as the biggest winners, with unclear regulation and cybersecurity concerns cited by a majority of bankers as the biggest obstacles they will face when adopting the new Open APIs technologies.

HONG KONG, Dec 12 (Bernama-BUSINESS WIRE) -- gini, the Hong Kong based data-driven banking solutions provider reveals a recent survey on Open APIs readiness among Asian fintech industry professionals. Only 20% of bankers saw themselves as the winners from Open APIs, even though 70% said sharing customer data is the future of their business. Fintechs are viewed as the biggest winners, with unclear regulation and cybersecurity concerns cited by a majority of bankers as the biggest obstacles they will face when adopting the new Open APIs technologies.

Conducted by gini enterprise, gini’s B2B arm, the survey questioned over 300 fintech-industry professionals in Singapore and Hong Kong in November 2019.

“Open Banking is sweeping across the Asia-Pacific region and regulators are making open banking a new reality. But their approach is “soft,” leaving banks and fintechs with plenty of latitude regarding implementation. Based on the survey results, we have published a research report, Open Banking 2020 to identify the opportunities for all participants, as well as recognize some of the barriers to adoption. As a fintech, we hope we can help shape this industry revolution and facilitate meaningful conversations on Open Banking,” said Raymond Wyand, CEO and co-founder at gini.

The survey reassured the importance of sharing consumer data. A greater portion of bankers (70%) responded that the ease of sharing customer data is “the future of my business” than respondents at technology companies, consultancies, investors, or other industry players.

Bankers also have a slightly different sense of risks. Although cybersecurity (38%) was the most cited risk by respondents, those from banks were more concerned with unclear regulations (23%). 35% of the respondents said the biggest winner from the Open APIs will be fintechs or techfins, outweighing customers, banks, and other consumer-facing companies.

Open Banking 2020 is the original research done by gini enterprise and is free to download. It consolidates genuine feedback from fintech practitioners in APAC, analysing the current and anticipated challenges, and creating a holistic picture for people working in fintechs, banks and technology.

Want to learn more? Click here to download the full report.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20191211006010/en/

Contact

For Media Enquiries:

Stella Wong

stella@gini.co

+852 9370 4586

Source : gini

--BERNAMA

“Open Banking is sweeping across the Asia-Pacific region and regulators are making open banking a new reality. But their approach is “soft,” leaving banks and fintechs with plenty of latitude regarding implementation. Based on the survey results, we have published a research report, Open Banking 2020 to identify the opportunities for all participants, as well as recognize some of the barriers to adoption. As a fintech, we hope we can help shape this industry revolution and facilitate meaningful conversations on Open Banking,” said Raymond Wyand, CEO and co-founder at gini.

The survey reassured the importance of sharing consumer data. A greater portion of bankers (70%) responded that the ease of sharing customer data is “the future of my business” than respondents at technology companies, consultancies, investors, or other industry players.

Bankers also have a slightly different sense of risks. Although cybersecurity (38%) was the most cited risk by respondents, those from banks were more concerned with unclear regulations (23%). 35% of the respondents said the biggest winner from the Open APIs will be fintechs or techfins, outweighing customers, banks, and other consumer-facing companies.

Open Banking 2020 is the original research done by gini enterprise and is free to download. It consolidates genuine feedback from fintech practitioners in APAC, analysing the current and anticipated challenges, and creating a holistic picture for people working in fintechs, banks and technology.

Want to learn more? Click here to download the full report.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20191211006010/en/

Contact

For Media Enquiries:

Stella Wong

stella@gini.co

+852 9370 4586

Source : gini

--BERNAMA

No comments:

Post a Comment